We are trusted by more than 1,000 clients

The Credit Information Sharing Association of Kenya (CIS Kenya) was set up to institutionalize the National Credit Information Sharing (CIS) Forum. The Forum was created in early 2012 in order to bring together both bank and non-bank credit providers to map the way forward towards implementing full file comprehensive CIS in Kenya. Prior to the formation of CIS Kenya, the implementation of CIS in Kenya was spearheaded by the Kenya Credit Information Sharing Initiative (KCISI), a partnership between Central Bank of Kenya (CBK) and Kenya Bankers Association (KBA).

CIS Kenya was launched on September 24th 2013 (then referred to as Association of Kenya Credit Providers (AKCP)), and its Governing Council was constituted soon thereafter at its first AGM in November 2013.

In Mid-2014, CIS Kenya embarked on a strategic planning exercise to define its five-year focus, from 2015-2019.

Mandate

CIS Kenya’s broad mandate is to promote best practices in credit provision. Additionally, the association plays a leading role in fostering the growth of the credit market by working towards the implementation of an effective credit information sharing mechanism. This reflects CIS Kenya’s unique task which is to establish a self-regulatory mechanism centered on credit information sharing, that eventually yields benefits for credit providers, consumers and the economy at large.

Credit Sharing Information Specialists

Our specialists have a great deal of experience and skills in Credit Sharing Information.

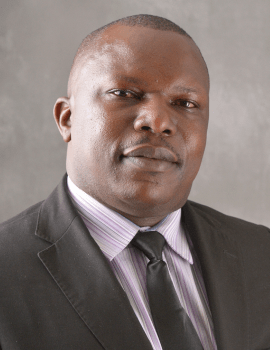

Jared Getenga

Chief Executive Officer

Tobius Sweta

Head of Finance

Hannah Ndarwa

Head of Legal and Human Resources

Job Mariga

Head of Projects and Technical Services

Lemuel Mangla

Head of Policy and Compliance