Empowering Young Women and Girls through Financial Inclusion

As the world marks the International Day of the Girl Child under the theme “Girls’ Vision for the Future,” we reflect on the dreams, aspirations, and voices of young women in Kenya. This theme conveys not only the urgency of addressing the challenges girls face but also the hope and power of their vision for a more equitable future. Central to this vision is the issue of financial inclusion, which holds immense potential to transform young women’s lives by providing them with access to credit, enabling them to pursue their dreams, and securing their place in the economic landscape.

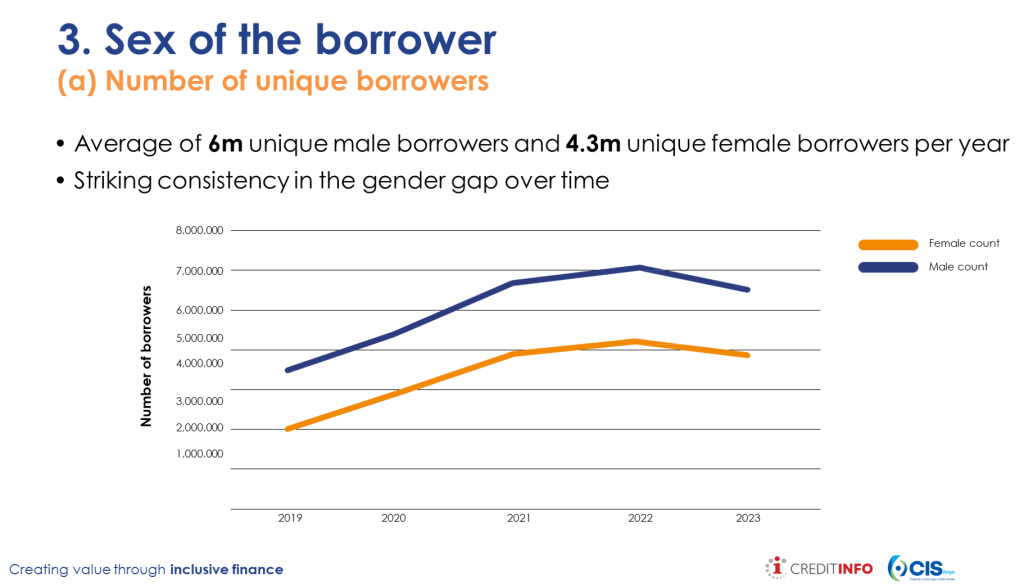

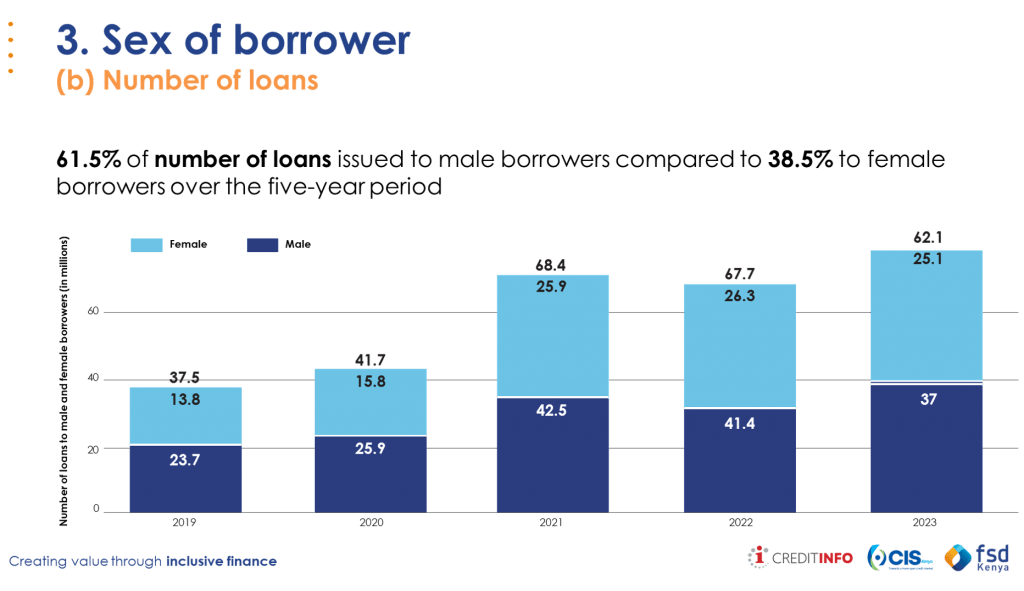

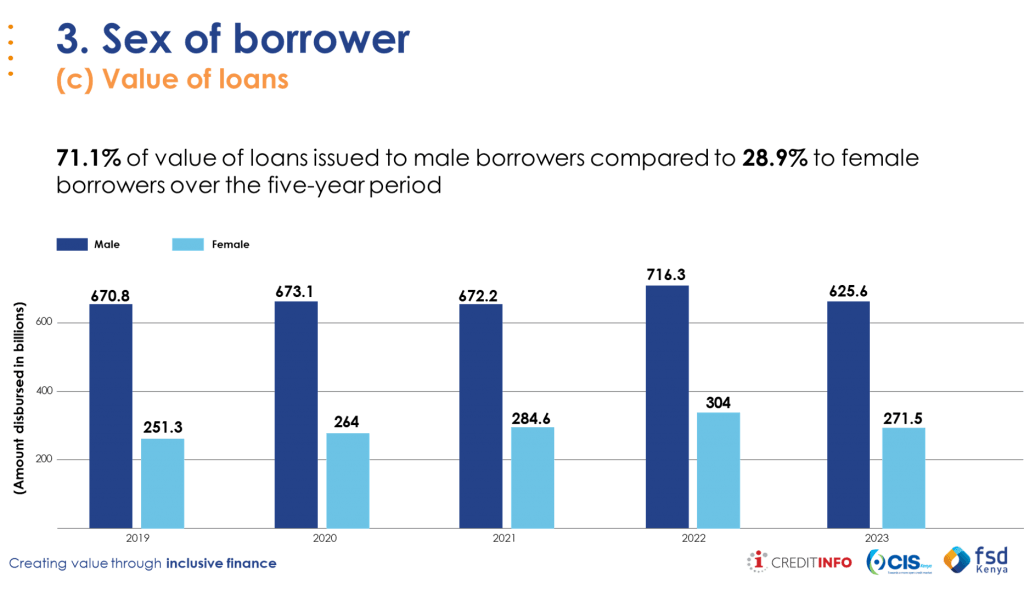

Despite the progress made in expanding financial services, young women in Kenya continue to face significant challenges in accessing credit. According to the recent report by FSD Kenya, CIS Kenya and Creditinfo CRB entitled “Kenya’s Credit Market Landscape: Demand-Side Analysis of Credit Records,” a notable gender gap persists in the credit market.

This disparity limits the ability of young women to start businesses, invest in education, and improve their overall livelihoods. As we celebrate girls’ voices and vision, it is essential to examine the barriers they face in accessing credit and explore solutions that can promote financial inclusion for young women.

Gender Gap in Credit Access

The report highlights a concerning reality: young women in Kenya are underrepresented in formal credit markets. Several factors contribute to men’s dominance in access to loans and financial services.

Deeply ingrained cultural stereotypes often portray men as more economically capable than women. This perception translates into women being seen as higher-risk borrowers. We also note that many women do not have ownership of assets like land or property, which are traditionally required as collateral for loans. The absence of assets that generally qualify as collateral disenfranchises young women’s eligibility for credit from formal financial institutions. The report also highlights the disparity in financial literacy between men and women. Lack of exposure to the knowledge and skills needed to navigate the financial system further restricts young women’s access to credit. As a result, many women’s entrepreneurship, education, and economic independence dreams remain out of reach.

What is the Impact of Financial Exclusion on Young Women?

The consequences of financial exclusion for young women are profound. The resulting limited economic opportunities traps many of them in cycles of poverty and dependence in such dimensions as:

- Economic Empowerment: Failure to start or scale businesses limits their income potential and economic growth.

- Education and Healthcare: Without access to financial resources, many young women cannot invest in further education or afford healthcare, which are critical for their long-term well-being and development.

- Vulnerability to Exploitation: Financially excluded young women are more vulnerable to predatory lending practices, exploitation, and informal credit arrangements that come with high-interest rates and unfair conditions.

Our Role in Promoting Financial Inclusion

At the Credit Information Sharing Association of Kenya (CIS Kenya), we recognize that sharing of credit information can be a powerful tool in promoting financial inclusion and helping to bridge the gender gap in credit access. Credit Information Sharing (CIS) involves the exchange of accurate and comprehensive information on borrowers, which helps lenders make informed decisions when evaluating loan applications. By expanding the scope of information available to lenders beyond the traditional sources, CIS can offer the following benefits to young women:

- Improved Access to Credit: With accurate credit histories available through CIS, lenders can assess a young woman’s creditworthiness and use their information capital as a substitute for traditional forms of collateral.

- Better credit terms: By reducing the risk associated with lending to young women, CIS can enable financial institutions to offer loans at lower interest rates and favorable conditions, allowing them to pursue opportunities more efficiently.

- Financial Empowerment: By actively building a positive credit history, young women can enhance their financial standing and access to better financial products and, in turn expand their businesses and/or invest in education.

To achieve meaningful progress in promoting financial inclusion for young women, several practical steps can be taken. Gender-specific financial education tailored to the specific challenges and needs of young women is essential. These programs will help equip women with the knowledge to manage credit, make informed financial decisions, and build their financial independence. Microfinance institutions such as Kenya Women Finance Trust and peer lending networks can provide young women with access to small loans without the need for collateral. Expanding support for these institutions can help bridge the credit gap.

We urge lenders to consider developing and promoting credit products that do not require traditional collateral, such as group lending models and data-driven credit products. Financial institutions should eliminate gender bias in assessment models, including adoption of more comprehensive evaluation factors beyond collateral and traditional credit scores. Likewise, Policymakers need to prioritize gender equality in financial services by enacting reforms that improve access to property rights.

Finally, as we celebrate the International Day of the Girl Child, it is important to highlight the unique capacity of the Girl Child. Girls have the vision, the power, and the hope to shape their futures. CIS Kenya is committed to playing its role in supporting that vision by providing them with the tools and resources they need to succeed.