The CIS ValiData

1. CIS ValiData Tool

We are thrilled to introduce the CIS ValiData Tool – a solution designed to make credit information sharing faster, more reliable, and easier for financial institutions. If you’re wondering how this tool works and why it’s so important, let us break it down for you.

2. What Is the CIS ValiData Tool?

It is a tool that helps credit providers check their credit data for errors before sending it to the credit bureaus. Think of it as a “data proofreader” that ensures everything is accurate and meets the required standards. By catching errors early, the tool saves time and ensures only quality data gets submitted. This process is crucial because reliable credit information helps lenders make quality decisions. It increases the reliability of credit bureau products reduces reliance on traditional collateral and promotes penetration of credit to individuals and MSMEs.

3. Why Does This Matter?

Good credit data means better financial decisions. When lenders trust the data they receive, they can confidently offer loans to more people, including those who might not have traditional forms of security like land or assets. This is a big step toward financial inclusion, where more people have access to affordable credit and can grow their businesses or improve their lives.

The journey of the CIS ValiData Tool began in 2013. At first, the idea was to create a central system to handle credit data from all lenders. However, concerns about data security and privacy led to a new plan – a tool that works directly with individual credit information providers.

By 2019, the design was ready, but challenges like lack of a framework to approve the tool, which was later introduced through the CRB Regulations, 2020 and delays caused by the COVID-19 pandemic slowed progress. Fast forward to 2023, and with support from the Bill and Melinda Gates Foundation through FSD Kenya, we upgraded the tool to meet the current business environment requirements and technological advancements. This version is now ready to roll out, pending final approvals.

4. How Does It Work?

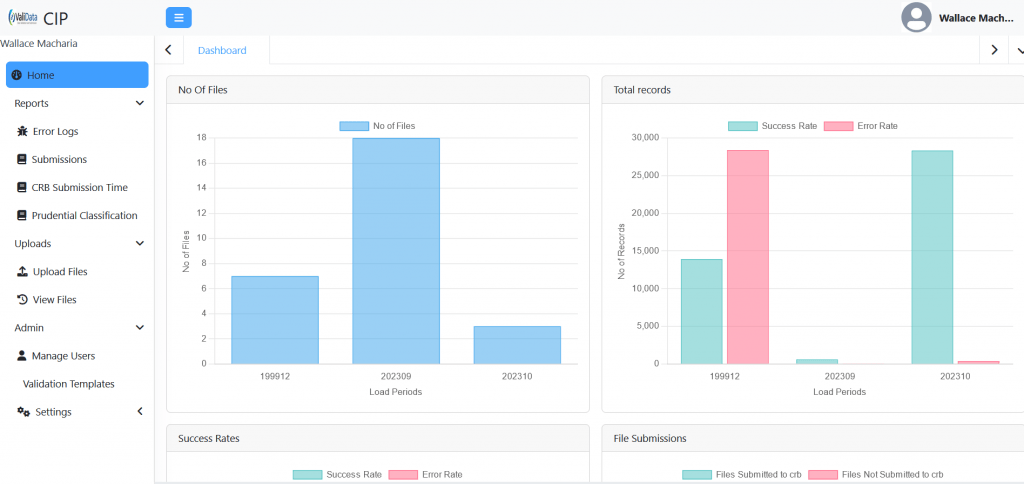

- Checks for Errors: It identifies and flags errors based on the set data standards and gives credit information providers an opportunity to fix them.

- Sends Data Seamlessly: Once validated, the data is securely transmitted to all licensed credit bureaus.

- Provides Real-Time Feedback: Institutions receive immediate reports on the status of their submissions, including details of any errors.

- Encourages Better Data Practices: By improving data accuracy, the tool helps institutions establish strong governance and include more borrowers, especially small businesses, in the credit system.

This tool isn’t just about fixing errors; it’s about transforming Kenya’s credit market. With quality and reliable data, lenders can make smarter, risk-based decisions, helping more people and businesses access affordable credit. The intervention will help the credit market achieve Kenya’s Vision 2030 goals of economic growth and financial inclusion. When the tool launches it will improve data quality by creating a proactive approach to addressing quality challenges on credit information providers, and provide more frequent updates through its real-time submission feature among others.

This innovation wouldn’t have been possible without the collaboration of many stakeholders such as FSD Kenya, The Kenya Bankers Association, AMFI-Kenya, DFSAK, CRBs, and members of CIS Kenya among others who have played a significant role in enhancing the tool’s features and ensuring its security. Their support, along with input from regulators, credit bureaus, and financial institutions, has brought us closer to creating a smarter credit ecosystem.

It represents teamwork, innovation, and a shared commitment to improving Kenya’s credit market. By addressing data quality issues and fostering trust among lenders and borrowers, this tool is set to revolutionize how credit information is shared and used – paving the way for a more inclusive financial future.